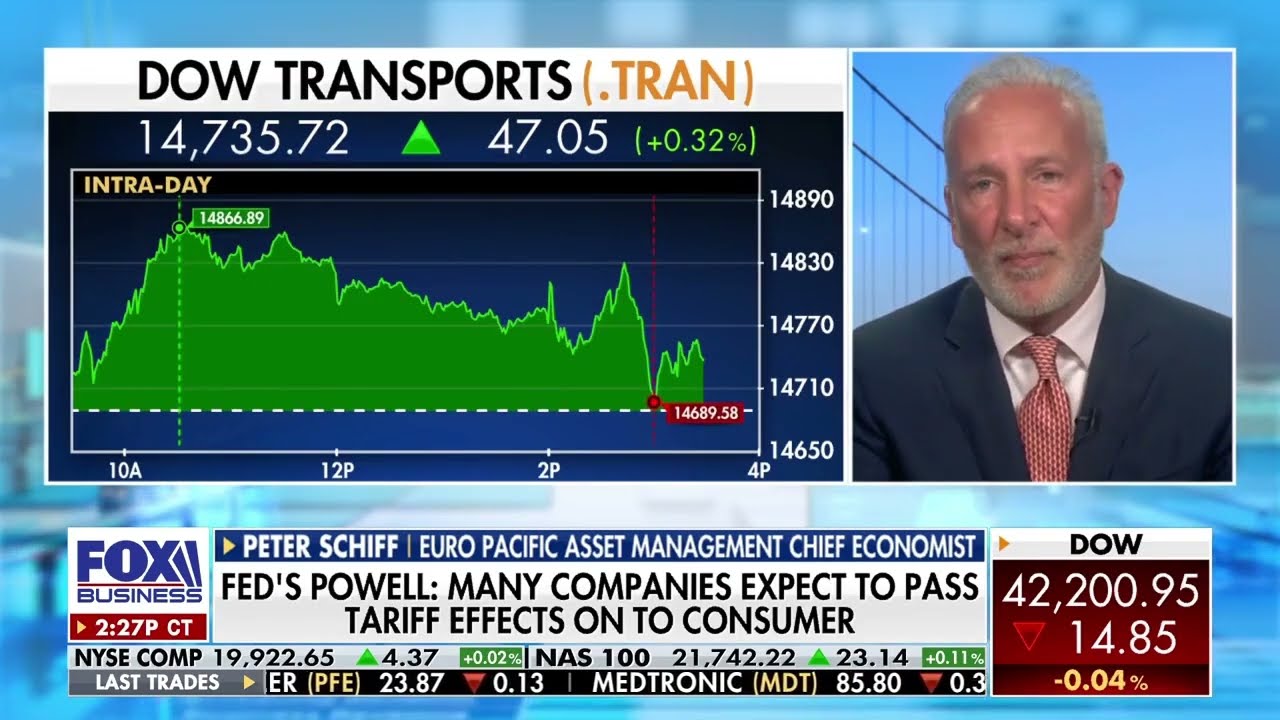

Peter Schiff and Andy Brenner on Federal Reserve policies, inflation forecasts, and the economy's future. Schiff critiques Fed …

source

Peter Schiff and Andy Brenner on Federal Reserve policies, inflation forecasts, and the economy's future. Schiff critiques Fed …

source

Input your search keywords and press Enter.

42 comments

hi peter, been buying gold for yrs, im literally already 50% gold in my portfolio, do you think i should just keep buying a little more every month, the rest in mostly in CASH etfs, should i keep buying even here around US$3400 ?

Peter Schiff has been predicting a recession every year since 2009…one of these years he'll be right…

Everyone keeps saying the next crash could be worse than 2008 and honestly, it’s starting to feel real. I’m seeing headlines about defaults, bank instability, and major global debt issues. If this is the “reset” they’re talking about, what does that even mean for our retirement savings?

inflation is not in goods and services but in stock prices, and it's true from the crisis 2008 after QE and more money printing. Inflation just do connected to the stock prices since than, not to goods and services – follow the stock markets

Since this video, 1 month later the Dow has gone up $2,200. If Fed rate goes down 2-3 pts before Labor day and at that time major tariff deals are finalized we will see another $3-5K increase in Dow by Christmas.

You telling it for decades and nothing happens …..

A much needed reset

I'm a firm believer in the value of a portfolio advisor. When the pandemic hit in March 2020, my investments were in disarray, and I was facing a financial crisis. But after seeking the advice of a seasoned professional, my portfolio began to flourish. The results speak for themselves: from an initial investment of $120k, I've now accrued over $550k – a testament to the power of informed investing!

The corrupt fed is not going to do anything to help the economy as long as Trump is in office bottom line

I believe Peter Not to cutting interest rates No one wants to purchase t bonds now

Remember that time every year for almost 2 decades that Peter called for everything to crash.

ITS ALL OVER GUYS!! 😂

If bitcoin is so awesome then why is wall street pushing for retail investment..they dont need us..only 21 million..why dont they buy it all…i can't wait to see Saylor in a cell next sbf

How the heck is this guy pushing for cuts? Too much stimulus is how we got here in the first place

The goat!!!!!

What is also required is to remove the dollar signs in the eyes of those that are cash poor and lazy looking for an easy break and a free windfall.

🤑🤑🤑🤑🤑🤑🤑

doom and gloom man is always wrong. Nasdaq fresh All time Highs, as always. How is it, being wrong for literally YEARS, hell might eben be DECADES lol. Loser.

The amount of times “i don’t know” is said in the video is proof enough that this isn’t what you need to listen to.

Peter is Spot on !

Schiff is right.

The only person more right than Trump – Peter Schiff.

lol wait what? When we had 2008 it still 'wasn't enough" for this clown, so the Title makes no sense, which is to say typically Peter Schiff-speak.

Inflation went up from 2.3 to 2.7 and this tool is recommending we cut interest rates? Why? To torture more Americans? What a tool!

Trump won’t want a recession on his watch. Turn on the money printers with zero interest rates.

I saw a few X-posts from you in the news feed and I'd like to thank you to speak out healthy common sense in between all the crazy erected moonboys

if anybody is wondering Euro Pacific Asset Management is located in Dorado, Puerto Rico, the hotbed of international finance

Peter, what you do think of Truflation's stats? It's a private sector measure of purchasing power decline.

GAY!!! Report this trash

WHAT A STUPID VIDEO. TO SCARE PEOPLE

FAKE TRASH. SO GAY

ANOTHER GAY VIDEO TO SCARE PEOPLE

A recession as bad as it can be, provides good buying and selling opportunities in the market if you're careful and it can also create volatility giving great short time buying and selling opportunities too. This is not financial advise but get buying, cash isn't king at all in this time.

It’s funny how one expert will completely contradict another. Highlights no one has a clue

One reason prices went, up real estate and rents went up or almost doubled , and that means producers and stores have to hike their pricing.

Schiff’s shiny is losing purchasing power to BTC everyday.

RIP Peter Schiff 😢

I mean if you listened to J. Powell at the meeting we should all be concerned. Trump effect baby

I held through 2008, kept buying, and profited for 17 years. Sold 80% in Jan knowing a crash was coming. Earning 4.5% on CDs now, should i rush to buy back in?

Blabla

One world United under digital currency…. may Father be with you and your family my brothers and sisters!

Where are the podcasts?

“Global exodus” but stocks are at record highs yet AGAIN. How many record highs since 2008? How many “V shaped” recoveries? The elites get it all

It's either QE to reinflate the bubble or debt default. No way is the US growing out of this level of debt with a population that's going to be shrinking due to cratering birthrates.

It's a case of pick your poison at this point.